china industrial etf

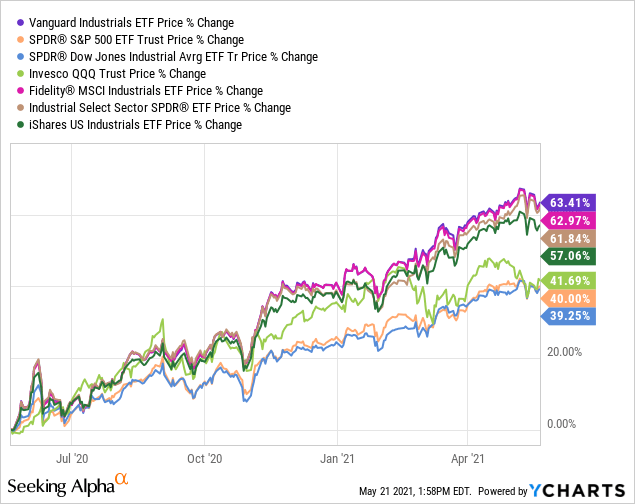

The industrial sector underperformed the broader market over the past year. The industrial exchange-traded funds ETFs with the best one-year trailing total returns are EVX PPA and ITA.

Msci China Industrials Etf Chii

Best China ETFs for A Shares.

. 77 of retail lose money. Country of ETF. Ad Met beleggen kunt u uw inleg verliezen.

China ETFs can be found in the following asset classes. Benchmark Index MSCI China index SFDR Classification Other Shares Outstanding as of 24Jun2022 186969501 Total Expense Ratio 040 Use of Income Accumulating Securities Lending Return as of 31Mar2022 002 Domicile Ireland Product Structure Physical Rebalance Frequency Quarterly Methodology Replicated UCITS Yes Issuing Company iShares. The United States Japan and European Union have.

This includes and is not. The best indices for ETFs on China. For an investment in the Chinese stock market there are 12 indices available which are tracked by 24 ETFs.

The KraneShares MSCI China Clean Tech ETF exposes investors to real estate industrial and technology companies practicing more environmentally friendly operations. China has seen about 205 ETF launches this year with 18 of them technology themed 11 green energy themed and 10 Star-market themed according to data from Wind. Nu tot 200 transactiekosten tegoed lees voorwaarden.

Find the latest Global X MSCI China Industrials ETF CHII stock quote history news and other vital information to help you with your stock trading and investing. The top holdings of these ETFs are Class H shares of China Construction Bank Corp. These emerging-market ETFs are relatively insulated from China.

Nu tot 200 transactiekosten tegoed lees voorwaarden. Probeer de gratis demo. ETF industry at loggerheads following Tesla.

Equities may consider CHII as well. Ad Met beleggen kunt u uw inleg verliezen. There arent many established China ETFs beyond our list of 10.

Sizing up China inside popular ETFs Owning Chinese markets is not a one-size-fits-all proposition. The ETF is heavily weighted towards Taiwan and South Korea which means you get less exposure to China than in all of the other ETFs in this list bar one. Industrial portfolios seek capital appreciation by investing in equity securities of US.

In the last trailing year the best-performing Industrials ETF was SIJ at 3662. China is the worlds second-largest economy in terms of gross domestic product and its rapid growth has it on track to take over the. Those looking to overweight China may find this ETF useful for fine tuning exposure while investors bullish on the outlook for industrial stocks but hesitant to invest in US.

The iShares MSCI China ETF MCHI provides exposure to international investors to large and mid-sized companies in China which constitute 85 of the Chinese stock market. Ad Buy and Sell ETFs Online. Learn different ways to navigate China in portfolios.

Here you can read my opinion about this ETF and you can follow my ETF trading. Industrial And Commercial Bank Of China Ltd. Foreign Investors sold on the long term Sino growth must rather consider index controlled Chinese Industrial Funds that will allow a wide spectrum portfolio and an equated weight age among the top most liquid stocks from the Industrial Machinery that runs the massive country and its more than a billion citizens.

Learn more about long and short-term performance expenses holdings and quant ratings. On a daily basis I follow this Global X China Industrials ETF. The largest Industrials ETF is the Industrial Select Sector SPDR Fund XLI with 1270B in assets.

This ETF offers exposure to Chinas industrial sector making it one of the most precise tools available in the ETF universe. Companies that are engaged in services related to cyclical industries. Probeer de gratis demo.

The metric calculations are based on US-listed China ETFs and every China ETF has one issuer. China Construction Bank Corp 00939. Millions of Traders have already chosen Plus500.

At the point of writing the HKSE listed MSCI China ETF by iShares is cheaper with an expense ratio of 02 compared to the 057 of its NASDAQ listed MSCI China ETF counterpart. A non-diversified ETF tracks the MSCI China IMI Environment 1040 Index investing at least 80 in its underlying index and associated depository receipts. ETF issuers who have ETFs with exposure to China are ranked on certain investment-related metrics including estimated revenue 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields.

The Global X China Industrials ETF CHII offers exposure to the growth engine of the Chinese economy investing in engineering and. China ETFs are exchange-traded funds that track publicly listed Chinese companies and give investors exposure to Chinese markets without having to. The speciality of investing in China are the different categories of Chinese stocks.

READ NOW Key Facts Net Assets of Fund as of May 10 2022 5724995712 Fund Inception Mar 29 2011 Exchange NASDAQ Asset Class Equity Benchmark Index MSCI China Index Bloomberg Index Ticker M7CN. The ETF was launched in. ETF Summary The Global X MSCI China Health Care ETF CHIH seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Health Care Sector as per the Global Industry Classification System GICS.

The best performing China ETFs for 2022 include CHIE ASHS CHII. If you just want to invest in one China ETF iShares Core MSCI China ETF HKS2801E would be a good choice. Equity Fixed Income Currency The largest China ETF is the iShares MSCI China ETF MCHI with.

The China exchange-traded funds ETFs with the best one-year trailing total returns are CHIX KBA and CNYA. The total expense ratio TER of ETFs on these indices is between 019 pa.

2 Etfs To Consider As Lockdowns Ease In China Etf Trends

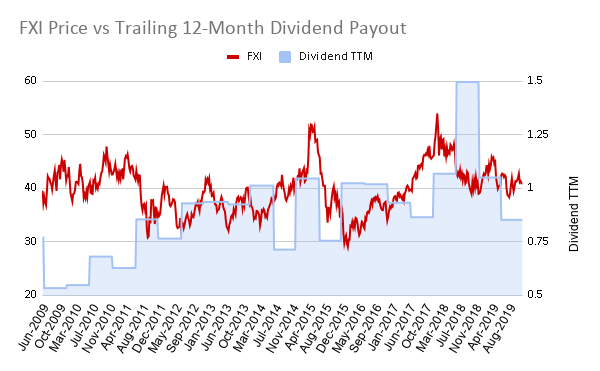

Fxi Ishares China Large Cap Etf Etf Quote Cnnmoney Com

Fxi Lost Decade In China Large Cap Etf Will Likely Continue Nysearca Fxi Seeking Alpha

Msci China Industrials Etf Chii

A China Internet Etf You Should Know Etf Com

Chinese Internet Weekly Potential Relief For Baba Investors Tal Stock S Silver Lining Seeking Alpha

Asia Etf Roundup Industry December 2021 And Morningstar

China Tech Etfs Cheap And Easy To Invest In China

What Happens To Your Etfs If Chinese Stocks Delist Morningstar

A China Internet Etf You Should Know Etf Com

Vis Vanguard Industrial Etf Gives Investors What The Dow Jones Doesn T Nysearca Vis Seeking Alpha

Inverse China Etfs At Support Amid Slowdown Fears

Alibaba And Pinduoduo Are Banking On Esg Baba Pdd Seeking Alpha

3 Etfs For Investing In China Tech Boom Etf Com

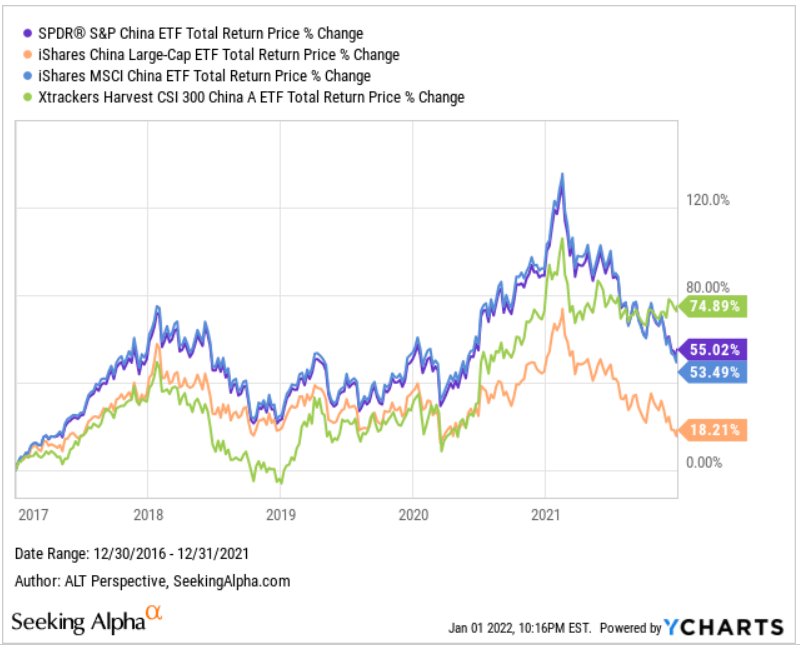

Is The S P China Etf A Good Choice For Exposure To Chinese Stocks Nysearca Gxc Seeking Alpha

The China Etf Investment Checklist

What Can The Newly Approved Etf Connect Between Mainland China And Hong Kong Bring To Foreign Investors

How To Short China S Stock Market With Etfs Etf Com

:max_bytes(150000):strip_icc()/TopETFsthroughDec.22021-7388ec5349294c67b33dc6dc2cb8e171.png)

0 Response to "china industrial etf"

Post a Comment